how to avoid tax on 457 withdrawal

They do not come with early withdrawal. For this calculation we assume that all contributions to the retirement account.

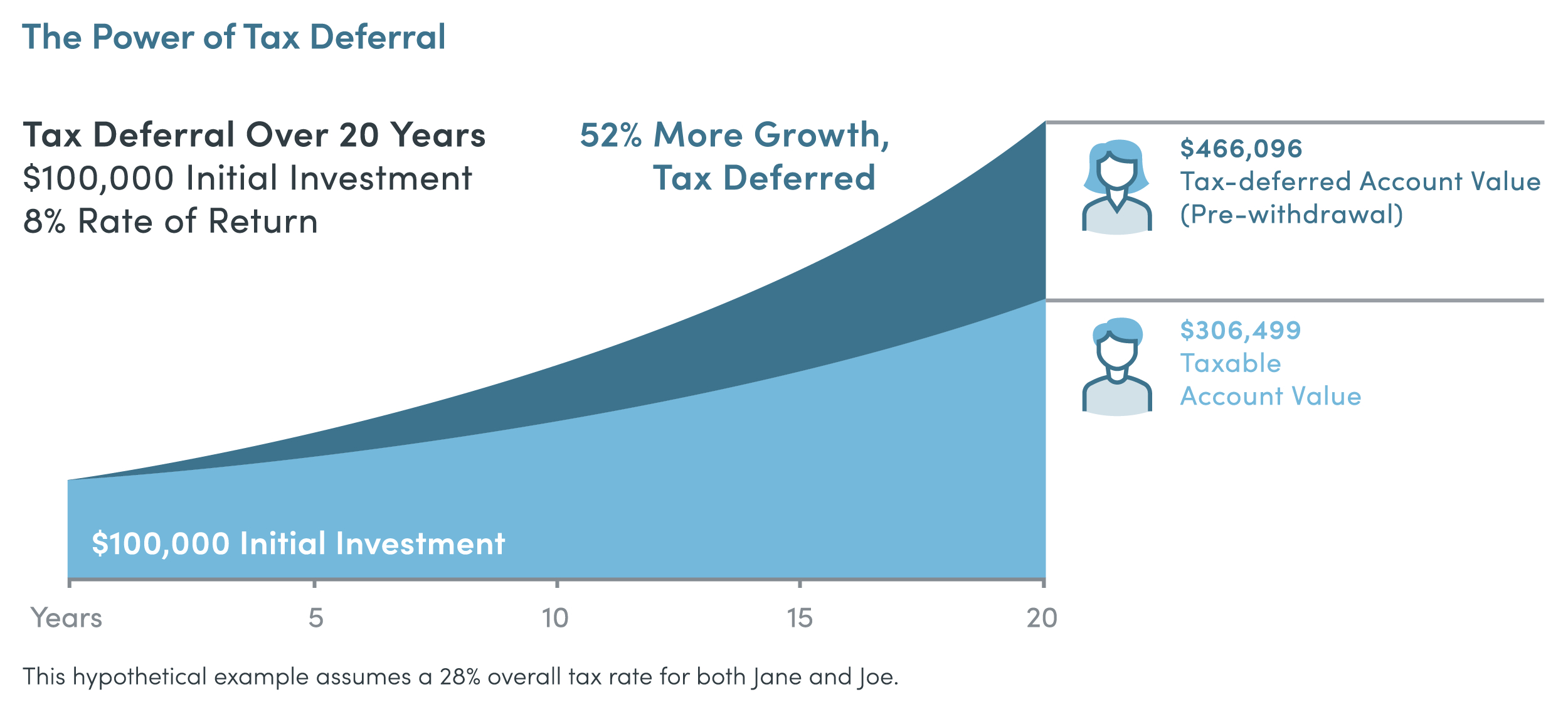

How Tax Deferral Works Securitybenefit Com

In addition to any taxes you owe on your withdrawal you will owe an additional 10.

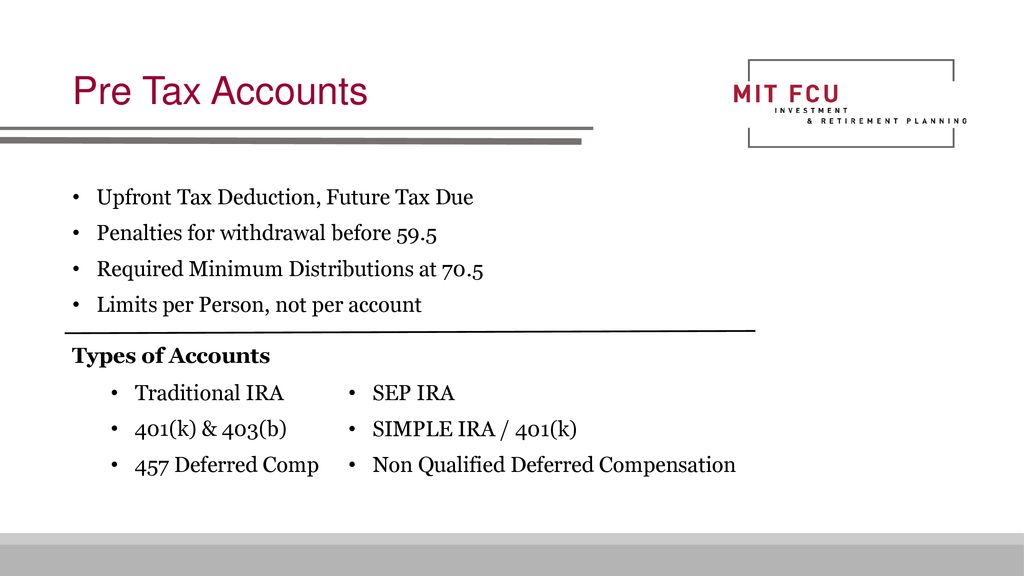

. Can you withdraw money from a 457 B plan. A 457b plan is a tax-advantaged retirement plan restricted to state and local public governments and qualifying tax-exempt institutions. All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates.

If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Taking withdrawals from an individual retirement account IRA before you reach age 59 12 is generally considered an early. As with a 401k plan you can get a tax deduction on.

The amount you wish to withdraw from your qualified retirement plan. Withdrawals are subject to income tax. Get a 457 Plan Withdrawal Calculator branded for your website.

However if you are. Hardship withdrawal penalties can be avoided by allocating the money to qualified university expenses such as tuition books and board. For this calculation we assume that all contributions to the retirement account.

Here is a list of the key rules. Market Trading Essentials March 12 2022. Withdrawal Rules for a 457b Account.

The ability to avoid the early withdrawal penalty if. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. Dont take nonqualified distributions early.

Colorful interactive simply The Best Financial Calculators. The early withdrawal penalty is a 10 penalty. Beneficiary distributions avoid the early withdrawal penalty of 10 percent.

Withdrawals are subject to income tax. When it comes to withdrawals 457b plans have a big advantage over 403bs and 401ks. If you have a 457 b you can withdraw the budget from your account without any early withdrawal penalty.

Withdrawing money from a. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans. 16 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be.

457 Plan Withdrawal Calculator. The amount you wish to withdraw from your qualified retirement plan. However if you withdraw from.

If you withdrew 15000 from your 401 k you may be able to pay a 12 tax rate on that money instead of the 22 you might pay in a higher earning year.

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

Investment Accounts Pre Tax Post Tax And Everything In Between Ppt Download

How Can I Get My 401 K Money Without Paying Taxes

Roth 401k Withdrawals The Fi Tax Guy

Should You Pay Off Your Home With Retirement Funds Pros And Cons

Can I Max Out My 401k And 457 Here S How It Works

How 403 B Loans Work The Motley Fool

What Is A 457 B Plan Forbes Advisor

The Taxman Leaveth 2021 A No Tax Early Retirement Physician On Fire

:max_bytes(150000):strip_icc()/GettyImages-1353850562-5a09f8cd494ec9003739b86b.jpg)

Are 457 Plan Withdrawals Taxable

Traditional Vs Roth Employer Plans Real World Made Easy

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Taxes On Retirement Accounts Ira 401 K Distributions Withdrawals

How Can I Get My 401 K Money Without Paying Taxes

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

Using The Rule Of 55 To Take Early 401 K Withdrawals Smartasset

:max_bytes(150000):strip_icc():gifv()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)